Seize the Strategic Market of the Livestock Industry, and Build an Integrated Professional Platform for Veterinary Drugs

Animal Health & Feed Zone of CPhI China 2019 to Build a New Benchmark for the Industry

Size of the global veterinary drug market continues to grow as the market continues to develop. According to the forecast of the Forward Industry Research Institute, size of the global veterinary drug market will maintain about 7.3% average annual growth from 2017 to 2022, and is expected to reach RMB537.2 billion in 2022. China’s veterinary drug field is now experiencing a period of rapid growth, but the gap between production and demand is still huge with the increase of people’s demand for animal protein and advancement of the large-scale and intensive degree of China’s livestock breeding. The total output value of veterinary drugs in China increased from RMB21.171 billion in 2008 to RMB52.2 billion in 2017, with the compound annual growth rate of about 11%, and China has become one of the countries with the fastest developing veterinary drug industries.

By 2018, there have been over 600 veterinary drugs of nearly 150 overseas veterinary drug enterprises registered and marketed in China, mainly from the U.S., Canada, France, Spain, Germany, and other big pharmaceutical countries, with annual sales of about RMB5 billion. In terms of product type, most of them are vaccine or medicinal feed additive, with fewer pharmaceutical preparations; in terms of product attribute, vaccine products for diseases of pigs, poultry, and pets accounted for the highest sales proportion, with total value of RMB657 million, while imported chemical drug products were mostly medicinal feed additive, antibiotic, and anthelmintic, with total market value of about RMB489 million. Besides imported pharmaceutical products, Pfizer, Bayer, and other pharmaceutical giants have invested to build factories in China since 1980s, which have developed targeted products based on characteristics of the Chinese market through long-term and extensive market research, and upon product quality, brands, and technical advantages, rapidly opened the gate of high-end veterinary drug product consumption, seized the shares of the Chinese veterinary drug market, and provided more choices for circulation of the veterinary drug products.

Large international veterinary drug manufacturers have continued to improve their strength through acquisition, and produced far-reaching impacts on the veterinary drug industries of the developing countries through their financial, technical, and market advantages. To ensure the safety of the Chinese livestock industry, the Chinese government has gradually strengthened support to and regulation on the veterinary drug industry and it encourages the Chinese veterinary drug manufacturers to strengthen technology and product R&D to reduce the gap with overseas leading enterprises. China is increasingly drawing the attention of multinational groups in the outsourcing market competition as a big API exporter. Export volume of Shandong Qilu King-Phar, Lifecome Biochemistry, and Jinhe Biotechnology, etc. reached 10,000 tons in Jan-Sep 2018, and the export value of each exceeded USD25 million.

As a result, the global pharmaceutical giants have set their sights on the Chinese market. Well-known companies have competed to conduct investment layout in China over the years, and have spoken highly of the position of the Chinese market. The market, despite its hugeness, has a limited total amount, and the competition in China’s animal health market has become heated suddenly, as if it entered a “war”. There have been overseas enterprises that established animal health product facilities and set up R&D centers in China as early as 2009. And in addition to the vaccine and veterinary drug enterprises, some international enterprises that focus on animal nutrition, health, and feed additives have also increased their investments in the Chinese market. The paramount consideration for the heavy investments of the international enterprises in the Chinese market is the huge market capacity of China as a power in the global breeding industry: China is a big country of live pig and poultry breeding, accounting for a half of the global share, and this scale continues to grow. Actual gains and development obtained by the international enterprises in the Chinese market have also boosted their confidence in investing the Chinese market.

Scale of the zone to be upgraded again, to help veterinary drug enterprises lay out the global market

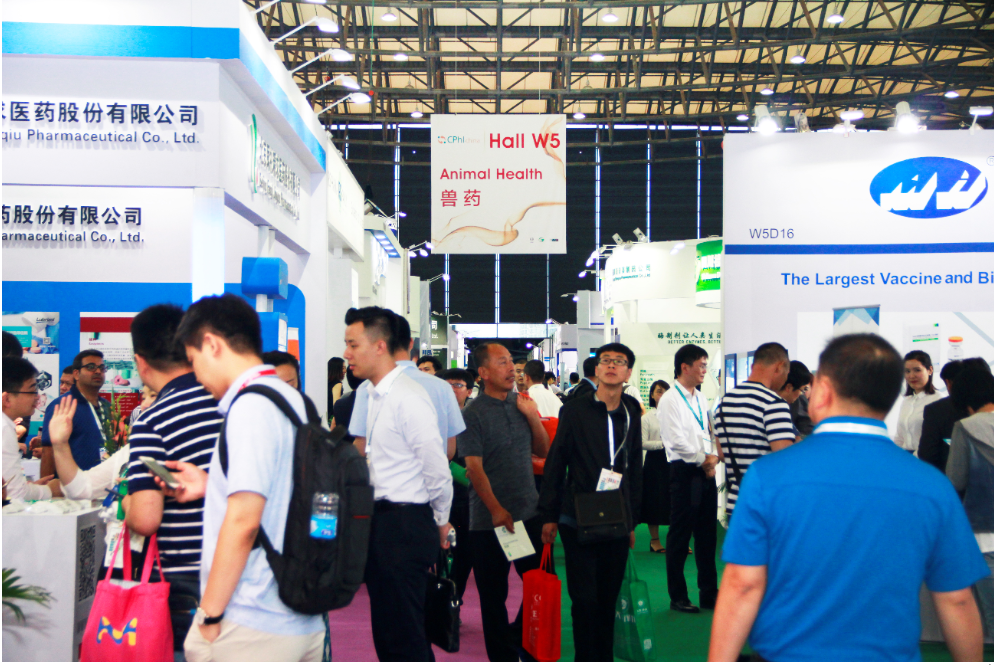

To help the veterinary drug industry achieve sound development throughout the industrial chain and meet the strong demand in the veterinary drug market, the Animal Health & Feed Zone, one of the characteristic segments of the CPhI China 2019 hosted by UBM EMEA and China Chamber of Commerce for Import & Export of Medicines & Health Products (CCCMHPIE) and co-sponsored by Shanghai UBM Sinoexpo International Exhibition Co., Ltd., will upgrade its scale again in Hall E7, Shanghai New International Expo Centre (SNIEC) on June 18-20, 2019. The exhibition has already attracted a large number of veterinary drug and feed exporters such as China Animal Husbandry, Shandong Shengli, Lifecome Biochemistry, Shandong Luxi Animal Medicine, and Hebei Veyong to join.

With the strong professional network and data resources of the host, the exhibition is expected to attract over 70,000 visits of overseas and Chinese visitors. CPhI China, the trade and exchange platform for the pharmaceutical industry second to none in Asia, gathers a total of over 3,200 upstream and downstream exhibitors of the pharmaceutical industry, and will effectively help industry enterprises develop quality suppliers that provide APIs, excipients, intermediates, packaging materials, and consumables, etc. with reliable quality and reasonable prices. Overseas veterinary drug and feed enterprises will not only be able to see on site the latest products and processes of feedstuff and additive, veterinary biological product, veterinary diagnostic reagent, veterinary API, veterinary preparation, and animal health product industries, etc., but also can use the exhibition as an excellent international professional exchange platform where they can talk face to face with decision makers of the Chinese veterinary drug, breeding stock, and feed enterprises to analyze industry policies, interpret main points of guidelines, and talk about trends of the Chinese and overseas veterinary drug and feed markets.

Visitor registration for 2019 now opens. Register online now to save the CNY 100 on-site fee! Visit www.cphi-china.cn/animal/en for more details.

Contact us:

Ms. Yingqi Shi

E: yingqi.shi@ubmsinoexpo.com

T: +86 21-33392421